For everything from a natural disaster, recent example being Hurricane Ian in Florida, to a public health emergency, like COVID-19, municipal governments are generally the first line of defence in ensuring an equitable response and strong financial footing to withstand such disasters.

For states where natural disasters are common, it’s imperative for municipal and state governments to ensure adequate plans to not only protect, clean, and rebuild but to also ensure ample liquidity reserves, coordination with federal authorities for help, and fiscal plans to emerge from these natural calamities. In addition, credit rating agencies, when assessing these municipal or state governments for credit risk, often look for these aforementioned plans in their credit risk review.

In this article, we’ll take a closer look at how municipal and state government revenues/financials and municipal debt are exposed to risk posed by natural disasters in the United States.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Key Areas of Consideration

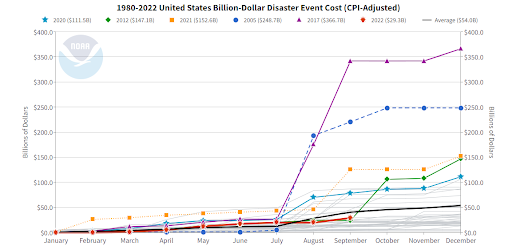

When assessing the overall risk from a natural disaster, there are a few key areas of focus that play a huge part in the municipality’s credit risk profile. However, before diving into the areas of focus, it’s also imperative to note that various natural disasters have been increasing in their intensity and frequency and ultimately leading to the total cost of these events.

The chart below highlights the aforementioned.

Source: National Centers for Environmental Information

Financial Preparedness Through Financial Reserves

More and more municipalities have moved toward building financial reserves related to contingencies and, more importantly, building a strong policy framework around the accumulation and use of these reserves. For example, states like Florida are familiar with hurricanes; depending on the severity of the disaster, they can end up costing billions of dollars in damages. Furthermore, the municipalities, where the damages have occurred, tend to front the cost related to the preparedness, clean-up, and rebuilding efforts.

In the financial preparedness framework, municipalities, through their annual budgeting process and approval from governing boards, will start accumulating liquidity reserves specifically for this purpose. This also means these are restricted reserves and cannot be used for any other purposes.

This framework of committed and/or restricted reserves enable municipalities to showcase their financial preparedness for credit rating agencies and their credit risk review. It’s important to note general reserves are broad in nature and can be used for a wide array of program/services, typically upon council direction. However, restricted or committed reserves are set out for areas related to their commitment.

Federal and State Assistance

In the event of a financial disaster, you’d also often see an activation of FEMA (Federal Emergency Management Agency) to provide help and also coordinate the state and federal efforts in addressing the natural disaster. As widely seen, state and municipal governments often need financial and strategic help from the federal government, which can improve planning efforts. A timely response and coordination are extremely important between different levels of government, which can determine how fast a municipal government recovers from natural calamities. Success in this preparedness section will often be determined through having a well-crafted coordination plan with neighboring jurisdictions and the federal government, as seen in the COVID-19 public health emergency.

Advanced Planning Framework

For municipal and state governments, planning is not limited to regularly occurring weather events or public health emergencies, but also the impacts of things like global warming or changing of weather patterns or even unnatural events like cyber-threats. For many municipalities around the U.S., their citizens rely on them to provide fresh clean water and services related to wastewater and/or storm water conservation. These areas of municipal government rely heavily on natural sources of water, which are vulnerable to events like droughts, etc. In that case, an operational preparedness plan to mitigate the risk of natural disasters is paramount. These plans often go hand in hand with the financial plan and typically forecast the level of operations and/or financial preparedness over a long period of time.

Don’t forget to check our Muni Bond Screener.

The Bottom Line

In the last few years, we have witnessed weather and public health events never seen before, especially to this level. A pandemic led to halting the global economy and impacted every city, county, and state in the United States. Prior to COVID-19, an event like this was considered improbable, – yet it happened and we witnessed the need for federal coordination with local and state governments to spearhead the emergency efforts.

In addition, as the frequency and intensity of natural calamities increase, rating agencies will pay even closer attention to the preparedness framework established by all levels of government.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.